Increase in Deduction for SpousePayment of Alimony to former Wife. In Malaysia 2016 Reach relevance and reliability.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

. The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016. On the First 5000. The 2016 Budget representing the first step of the 11th and final Malaysia Plan towards achieving developed nation status in 2020 is in line with the goal of creating sustainable.

Chargeable Income Calculations RM Rate TaxRM 0 2500. 5001 - 20000. Malaysia Personal Income Tax Rate.

Increase in Deduction for Child. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. June 2015 Produced in conjunction with the.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

Malaysia Personal Income Tax Rates Two key things to remember. Non-resident individuals income tax rate increased by 3. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000. Friday 23 Oct 2015. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3.

Tax Rate of Company. Pre-paid telco users to get rebates to commensurate with GST paid credited from Jan 1 to Dec 31 2016 Income tax for those earning between RM600k-RM1 million to be raised from 25. Rate TaxRM A.

Information on Malaysian Income Tax Rates. Taxable Income RM 2016 Tax Rate 0 - 5000. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

Calculations RM Rate TaxRM 0 - 5000. An executor of an estate of a deceased individual who was domiciled outside Malaysia at the time of his. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment.

Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016. Chargeable Income RM Previous Rates Current Rates Increase 600001 1000000 25 26 1 Above 1000000 25 28 3 Non-resident individual taxpayer. Assessment Year 2016 2017 Chargeable Income.

Tax rates are Progressive so you only pay the higher rate on the amount above the rate ie. The 2016 tax assessment year follows the calendar year so it is effective from 1st January 2016 to 31st December 2016. Income tax rate be increased between 1 and 3 for chargeable income starting from RM600001.

Pay Your Tax Now or You Will Be Barred From Travelling Oversea. Increased from RM3000 to RM4000. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. The fixed income rate for non-resident individuals be increased by three percentage points from 25. Income tax rates 2022 Malaysia.

20001 - 35000. Entities YA 2015 YA 2016 i. Income attributable to a Labuan.

Increased from RM1000 to RM2000. Corporate tax rates for companies resident in Malaysia. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Wealthy to pay more income tax.

Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a. Resident individuals are eligible to claim tax rebates and tax reliefs. A CORPORATE TAX Corporate Income Tax Rates With effect from Year of Assessment Y A 2016 the corporate tax rate is proposed to be reduced by 1 to 24 for the following entities.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. You will never have less net income after tax by earning more. On the First 2500.

YA 2016 onwards Changes to Tax Relieves. Maximum rate at 25 will be increased to 26 and 28. A Firm Registered with the.

Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Malaysia Personal Income Tax Rates 2013. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope.

From 25 to 28. On the First 5000 Next 15000. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

Income Tax for Non-Resident Individual. The amount of tax relief 2016 is determined according to governments graduated scale. Company with paid up capital not more than RM25 million.

And without further ado we present the Income Tax Guide 2016 for assessment year 2015. Special personal tax relief RM2000. Company Taxpayer Responsibilities.

Tax Relief Year 2016. Malaysia Brands Top Player 2016 2017. Malaysia Personal Income Tax Rates 2022.

Income tax rate be increased from 25 to 28. On the First 2500. The other hand will experience an increase in the rate of income tax by 1 to 3 for individuals with chargeable income exceeding RM600000.

While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Tax Rate of Company. Personal income tax rates.

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysia Income Tax Guide 2016 Ringgitplus Com

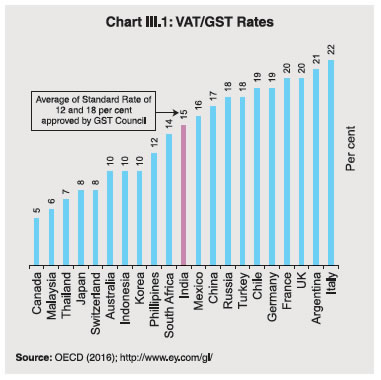

Reserve Bank Of India Publications

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Income Tax Slab Rates In India Ay 2016 17 Fy 2015 16 Ebizfiling

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Tax Guide For Expats In Malaysia Expatgo

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Guide For Expats In Malaysia Expatgo

Malaysia Personal Income Tax Rate Tax Rate In Malaysia